| Company | Value | Change | %Change |

|---|

The gloomy outlook from Godrej Consumer, one of the top five giants in the fast moving consumer goods (FMCG) space, is a sign of persistent stress in middle and low income households that Sitharaman will have to address in the upcoming budget in February 2025.

One of the biggest highlights of the July 2024 budget, right after the elections, was the increase in standard deduction for salaried employees to ₹75,000, along with income tax exemption for people making less than ₹3 lakh a year.

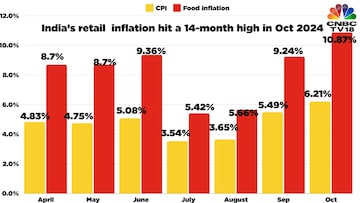

However, food prices have soared since then forcing people to cut back even on daily essentials. Will the Finance Minister be forced to consider more tax breaks and rebates for the middle class in the upcoming budget? Or, should she look at ways to sustain inflation at manageable levels?

India’s household budgets, particularly lower down the economic ladder, has been squeezed by slowing incomes and rising costs. The slump in consumer spending capped the country’s economic growth to 5.4% in the latest second quarter ending September 2024.

While the central bank governor and other ministers in the Narendra Modi government have projected better days ahead, neither the consumer product makers nor the buyers reflect similar optimism.

“Compared to September 2024 round of the survey, somewhat larger share of respondents expects the year ahead price and inflation to increase, mainly due to higher pressures from food items and housing related expenses,” the Reserve Bank of India (RBI) said citing the latest household survey conducted between November 2 and 11.

A month later, on December 9, shares of Godrej Consumer tumbled as much as 10% in morning trade after the soaps and detergent maker warned of yet another slow quarter due to shrinking demand.

While India has been the world’s fastest growing major economy for a few years, the momentum has largely been driven by government spending and rising demand for luxury items, from real estate to cars and jewellery, from the rich.

On the other hand, the overall urban demand has been on a downtrend for at least five quarters, a October 2024 report from consumer research firm Kantar showed.

For years now, the Modi administration has hoped that rising outlay for roads, highways, metro rail, and other infrastructure projects will inspire private capital and the combined benefits will trickle down to the middle class and the poor in the form of more jobs and higher incomes.

The consumer spending trends show that the result has been well short of the expectations despite a significant surge in budget allocation for infrastructure over the years.

Meanwhile, corporate profits have evaporated from the inflation heat. Higher income tax breaks have proven inadequate in a country where 45% of the workforce still has informal jobs, according to a SBI Research report from June 2024.

The government’s e-shram portal, a database created to provide social security benefits to unorganised people, has registered at least 304.5 million people since its inception in August 2021. At least 7 million people have registered since June this year.

Finance Minister Nirmala Sitharaman has the unenviable task of finding a durable solution to boosting growth without any further inflation. Reviving consumer demand is an urgent need because household spending contributed to 60.4% of India’s gross domestic product (GDP) at the end of June 2024.