Sources indicate that while an extension for Das is likely, several other candidates are reportedly in contention for the position.

These include Chief Economic Advisor (CEA) Ananth Nageswaran, Department of Economic Affairs (DEA) Secretary Ajay Seth, and current RBI Deputy Governors (DGs).

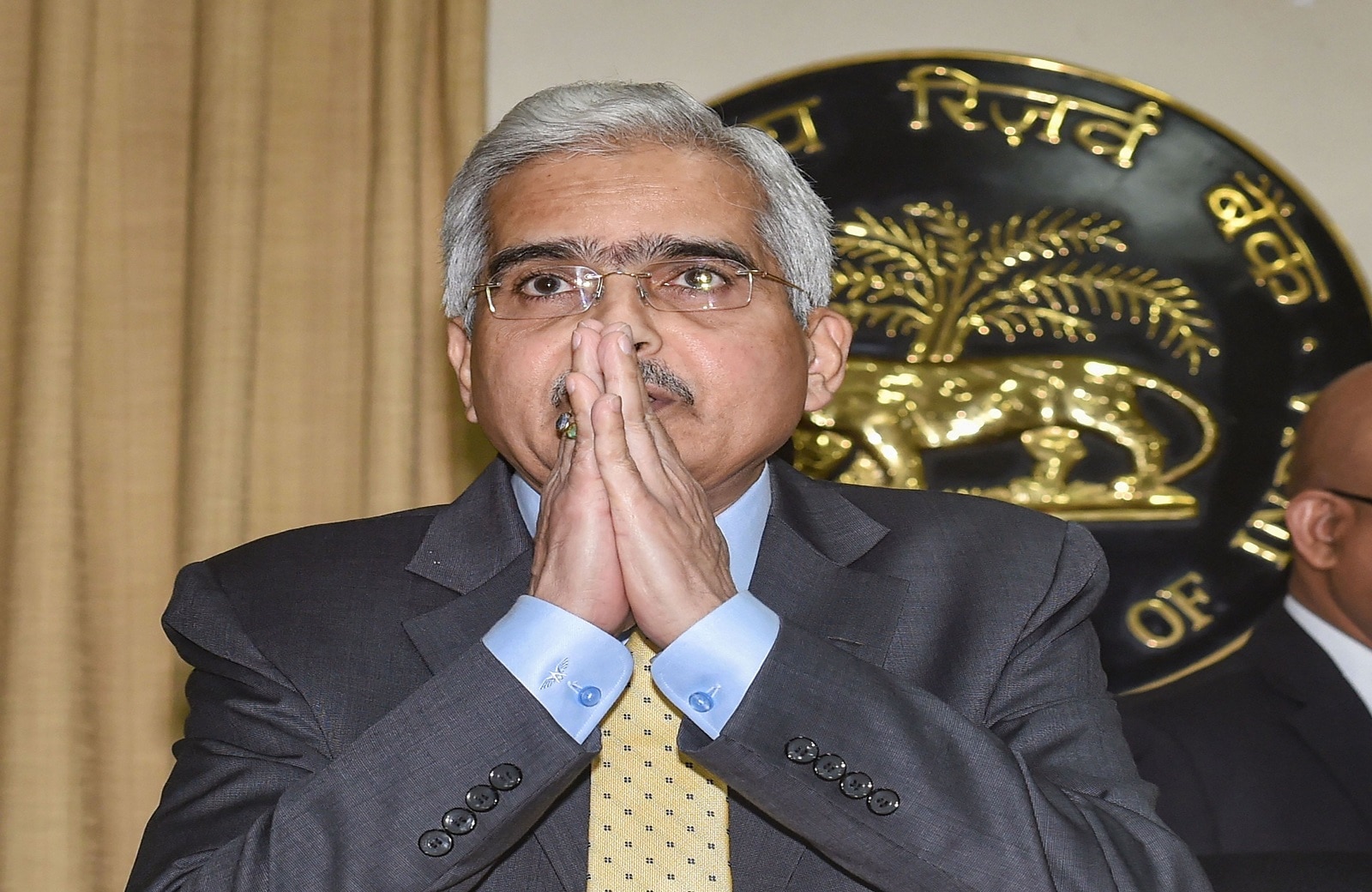

Das, who was first appointed in 2018 for a three-year term and later granted a three-year extension in 2021, is currently the longest-serving RBI Governor in seven decades.

While his reappointment is widely anticipated, his tenure comes at a crucial juncture as India grapples with economic challenges, including a slowdown in growth and rising inflation.

India’s GDP growth for the July-September quarter slowed to 5.4%, marking a seven-quarter low and falling short of the RBI’s 7% forecast.

Economists suggest that while a rate cut seems unlikely due to persistent inflation, the RBI may focus on liquidity management, particularly through adjustments to the Cash Reserve Ratio (CRR).

CRR is the portion of bank deposits held with the RBI, and a reduction would ease liquidity pressures by freeing up more funds for lending.

Axis Bank’s Deputy Managing Director, Rajiv Anand, expressed that while inflationary pressures remain, a CRR cut could provide relief to the banking sector.

“A CRR cut would ease liquidity and help reduce deposit-raising costs, which remain high despite the current repo rate,” he said.

As the RBI prepares for its policy meeting on December 6, economists are closely watching the central bank’s next steps to manage the growing concerns over inflation, which hit a 14-month high of 6.21% in October, driven largely by food price increases.

First Published: Dec 3, 2024 12:58 PM IST